Multiple Bank Accounts: A Strategic Approach to Better Financial Management

In today’s financial landscape, having more than one bank account isn’t just a luxury for the wealthy—it’s a smart strategy for anyone looking to organize their finances, maximize interest earnings, and simplify budgeting. As we take a closer look at the benefits and potential pitfalls of holding multiple banking accounts, it becomes clear that spreading your money across several accounts can be both practical and empowering.

This opinion editorial digs into the critical question: How many bank accounts should you really have? While conventional wisdom might urge minimalism, the actual answer is far more nuanced. In this article, we explore different account types, discuss the subtle details of maintaining multiple accounts, and offer actionable advice to help you figure a path through the tricky parts of financial organization.

Understanding the Purpose of Each Account

The idea behind splitting your money into different accounts is similar to diversifying your income—it’s about keeping your funds organized and available when you need them most. Each account should serve a specific purpose, whether that’s for daily spending, saving for long-term goals, or establishing an emergency fund. This method helps prevent funds from being commingled, making it easier to track spending and plan for the future.

Distinguishing Between Checking and Savings Needs

Let’s break this down into two major categories: checking accounts for everyday transactions and savings accounts designed for future needs. For most people, one checking account is enough for managing daily expenses, receiving paychecks, and paying bills. However, there are clear benefits to having a second checking account—which might be used to manage shared expenses with a partner or to separate personal finances from business-related transactions.

Everyday Checking Versus Special-Purpose Checking

When you have multiple checking accounts, it’s easier to keep personal expenses distinct from business or shared costs. For example, you might designate one checking account strictly for household bills and another for your personal purchases. This small twist in your financial habits can lead to enhanced clarity and fewer surprises when reviewing monthly statements.

- Everyday Accounts: Ideal for routine transactions like groceries, utilities, and entertainment.

- Joint Accounts: Perfect for families or couples who need to manage shared expenses such as rent or mortgage payments.

- Business Accounts: Essential for freelancers, small business owners, or anyone managing side hustles to separate income and expenses.

Moreover, the subtle details of account features such as minimum balance requirements, fee structures, and access to digital banking can make a significant difference in your banking experience. By taking a closer look at these details, you can steer through the potential pitfalls and capitalize on available rewards and incentives.

Criteria for Choosing the Right Checking and Savings Accounts

Before you open a new bank account, it’s important to consider a few key elements. These considerations help ensure that each account serves its intended purpose without turning into a financial headache.

Key Considerations for Checking Accounts

When selecting a checking account, many factors matter. Here’s what to look for:

- Minimum Balance Requirements: Some accounts mandate a minimum balance to avoid monthly fees. The last thing you want is an intimidating fee structure that undermines your savings.

- Access to Funds: Look for accounts that offer seamless access via debit cards, widely available ATMs, robust online banking platforms, and even local branches when you need face-to-face service.

- Fee Structures: Analyze common charges such as overdraft fees, non-sufficient funds fees, and foreign transaction fees. The goal is to find a checking account with minimal or no fees to maintain your financial efficiency.

Assessing Savings Account Options

Savings accounts play a critical role in maintaining financial health. Ideally, you should have more than one savings account to differentiate between emergency funds and long-term goals.

- Emergency Funds: This account should provide quick access with a safe, traditional setup—even if the interest rate isn’t the highest—since liquidity is paramount during a crisis.

- Long-term Goals: For saving toward a down payment on a home, a vacation, or other major expenses, online high-yield savings accounts can offer enticing annual percentage yields. Although these accounts might take a few days to transfer funds in an emergency, the increased returns can be worthwhile.

When reviewing savings account options, evaluate factors such as withdrawal limits, potential fees, and whether there is a minimum balance requirement. The idea is to balance liquidity with high-yield opportunities.

Advantages and Drawbacks of Opening Multiple Accounts

While the idea of having several bank accounts has many benefits, it’s not without its challenges. It’s important to understand both the pros and the cons before expanding your portfolio of accounts.

Pros: The Benefits of Diversification

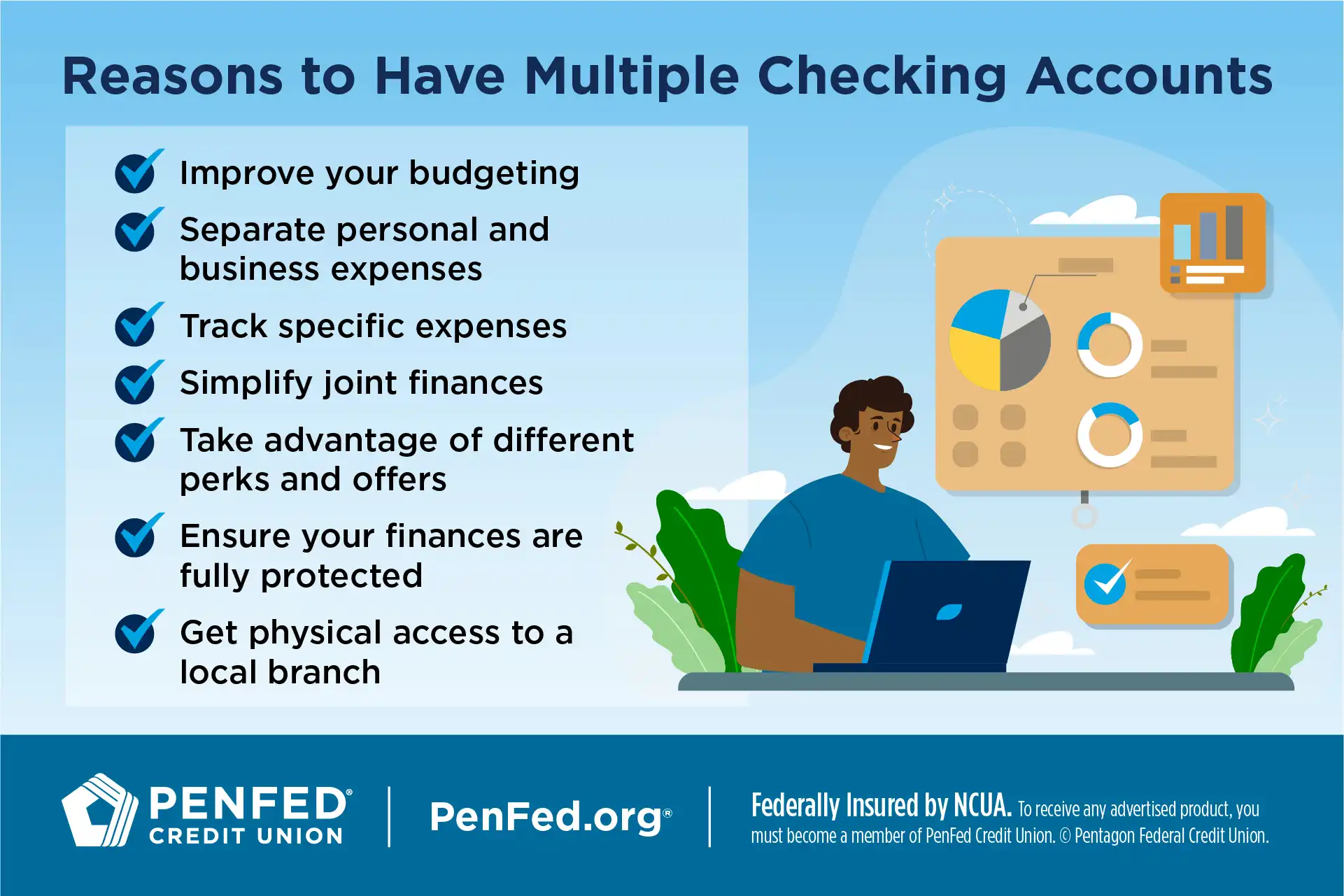

There are several clear advantages to having multiple bank accounts:

- Improved Financial Organization: Splitting your money among several accounts allows for improved tracking and can help reduce mix-ups in your finances.

- Customized Banking Needs: Each account can be tailored to serve a specific purpose—be it daily spending, saving for a big purchase, or managing shared bills with a partner.

- Multiple Bank Incentives: Different banks offer various perks, such as sign-up bonuses, referral programs, or cash-back rewards. Opening accounts at separate institutions may allow you to benefit from a host of promotional offers.

- Enhanced Budgeting: With defined roles for each account, you can track and manage your money more efficiently, ensuring that you are always on top of each category of expenses.

Cons: Managing the Tricky Parts

On the flip side, juggling multiple accounts can come with its own set of challenges:

- Complex Management: More accounts mean more logins, statements, and a greater need for organization. It can turn into a nerve-racking task if you don’t have a system in place.

- Risk of Additional Fees: With several accounts, the chance of incurring fees increases, especially if you fall short of the minimum balance or forget a scheduled transfer.

- Dispersed Funds: There’s the potential for your money to be too spread out, making it harder to build a sizable balance in any one account that might yield better interest rates.

- Time-Consuming Monitoring: Keeping track of multiple bank statements and account activities can be overwhelming if you’re not using the right tools to manage them.

Strategies for Effectively Managing Multiple Bank Accounts

Successfully handling multiple accounts doesn’t have to be overwhelming. With the right approach and planning, you can benefit from a well-organized financial system without getting bogged down by the twists and turns along the way.

Labeling and Categorization: The First Step

One of the best ways to keep track of your diverse accounts is to clearly label them. Whether you name an account “Emergency Fund,” “Everyday Checking,” or “Future Home Down Payment,” giving each account a specific, recognizable title helps you figure a path when reviewing your finances.

Consider maintaining a simple spreadsheet with columns for account name, purpose, balance, and notes regarding any fees or transfer limitations. This method of organization allows you to quickly assess where each portion of your money is allocated and prevents mixing up funds across different goals.

Automate Transfers and Payments

Automation is your friend when it comes to managing multiple bank accounts. By setting up recurring transfers from your main checking account to your designated savings accounts, you ensure that you consistently contribute to your financial goals without having to remember each month manually.

Similarly, automating bill payments prevents missed due dates and helps maintain steady balances in each account. This not only makes your day-to-day financial management easier but also reduces the confusing bits associated with juggling multiple transactions.

Utilizing Technology and Financial Apps

In an era of rapid technological advancement, there are numerous budgeting and financial tracking apps designed to help you keep tabs on multiple bank accounts with ease. Whether it’s a comprehensive budgeting tool like Monarch or a joint financial management app like Honeydue, these platforms integrate seamlessly with various banks to present a unified view of your finances.

Modern apps offer features such as:

- Net worth tracking

- Expense categorization

- Real-time balance updates

- Automated budgeting suggestions

- Alerts for low balances or pending bills

By taking advantage of these tools, you can reduce the nerve-wracking task of manually reviewing multiple bank statements and ensure that the little details don’t slip through the cracks.

Real-World Scenarios: When Extra Bank Accounts Make Sense

While the concept of multiple bank accounts might sound appealing in theory, understanding real-world applications can help illustrate when this strategy becomes especially useful. From managing shared household expenses to separating business finances from personal funds, there are plenty of scenarios where multiple accounts can remove the tangled issues of mixed spending.

Shared Expenses in Joint Financial Arrangements

For couples or families, separating shared bills from individual spending is not only practical but also creates a transparent environment for financial planning. A joint account dedicated solely to recurring household expenses—such as rent, utilities, and groceries—helps in keeping personal spending private while ensuring that shared responsibilities are covered without overlap.

This approach can be especially beneficial when:

- Budgeting Together: Couples can easily track their shared expenditures and even set aside funds for joint goals like vacations or home improvements.

- Avoiding Conflict: A clearly defined joint account minimizes the nerve-wracking debates over which expenses belong to which individual, smoothing out the fine points of marital budgeting.

- Transparency in Money Management: Both partners have access to the account, making financial planning more collaborative and reducing the small twists that often cause misunderstandings.

Freelancers and Small Business Owners: Keeping Business and Personal Finances Separate

For those who freelance or run small businesses, the challenge of distinguishing between professional income and personal spending is a recurring one. A dedicated business account not only simplifies bookkeeping and tax preparation but also positions you to better track business cash flow and manage expenses.

Keeping business and personal transactions separate helps in several ways:

- Simplified Tax Filing: With clearly demarcated expenses, identifying deductible costs becomes easier during tax season.

- Improved Financial Clarity: You get a very clear picture of how well your business is doing without it being muddled by your personal spending habits.

- Streamlined Budgeting: Assigning separate accounts lets you put appropriate funds into savings, investments, or reinvestment in the business with accuracy.

Making the Most of Bank Incentives and Promotions

Another compelling reason to hold more than one bank account is the opportunity to tap into various bank incentives and promotional offers. Banks often roll out sign-up bonuses, referral rewards, and even cash-back promotions aimed at attracting new customers. By opening accounts across different institutions, you can potentially capitalize on these rewards.

Maximizing Sign-Up Bonuses and Cash-Back Offers

Many banks offer attractive sign-up bonuses as long as you meet certain spending or balance requirements within a specified period. For instance, one bank might offer a substantial cash bonus when you deposit a minimum amount or use your debit card for a particular number of transactions. By strategically planning which accounts to open and meet the stipulated requirements, you can see a tangible benefit that contributes to your overall financial health.

Some essential tips include:

- Researching Offers: Regularly check for promotions and review the fine shades of each offer’s conditions.

- Meeting Requirements: Make sure you have enough funds to meet minimum deposit thresholds and any recurring balance requirements.

- Tracking Deadlines: Keep diligent records of when promotions expire to avoid missing out on potential incentives.

Combining Rewards with Strategic Saving

Opening accounts at multiple banks not only diversifies your funds but also allows you to combine various rewards with your saving goals. While one bank might provide an outstanding high-yield savings rate, another might offer better checking conveniences. By adopting a hybrid approach, you can take advantage of the twists and turns of each institution’s rewards program and tailor your overall banking strategy to meet your personal financial objectives.

Overcoming the Challenges: Tips for Consolidating Your Financial Life

Even though multiple bank accounts can streamline your financial life, they can also introduce complications if not managed properly. Here are some actionable strategies to ensure you don’t get lost in the fine points of juggling too many accounts:

Regular Financial Reviews

Set aside time each month to sit down and figure a path through your finances. Reviewing account balances, fees, and spending patterns can help you spot any trends or issues before they become overwhelming. This regular check-up serves as an opportunity to consolidate your understanding and adjust transfers or automate more processes if needed.

Maintain a Centralized Dashboard

Consider using financial management software which aggregates all your bank accounts, investments, and loans into one dashboard. This centralized approach minimizes the risk of funds being too spread out and allows you to see the big picture without getting bogged down in the small distinctions of each account’s daily fluctuations.

Set Clear Boundaries and Goals

Each account should have a well-defined purpose. Establish clear goals, whether it’s building an emergency fund, saving for a down payment on a house, or managing daily expenditures. When you know what each account is designed for, you can manage your way through transfers and fund allocations with greater ease and reduced confusion.

| Account Type | Purpose | Key Features |

|---|---|---|

| Everyday Checking | Daily spending, bill payments, direct deposits | Low fees, wide ATM network, online banking |

| Joint Checking | Shared expenses with a partner or family | Collaborative access, clear expense tracking |

| Business Account | Freelance or small business transactions | Separation of personal and professional funds, easier tax preparation |

| Savings (Emergency) | Quick access during financial crisis | High liquidity, balance security |

| Savings (Long-term Goals) | Future investments like a home down payment | High-yield interest rates, online management |

The Bottom Line: A Customized Approach to Financial Stability

There isn’t a one-size-fits-all answer when it comes to the number of bank accounts you should maintain. The right number depends on your lifestyle, financial goals, and preferences for managing your money. For some, a simple setup of one checking account and one savings account might be sufficient. For others, especially those with shared financial responsibilities or multiple income sources, multiple accounts offer a clearer, more organized way to handle finances.

It’s important to remember that while too many accounts can complicate things, the strategic use of multiple accounts can help you steer through the often intimidating and confusing bits of financial management. By clearly designating what each account is for—be it everyday spending, business transactions, or long-term savings—you empower yourself to make smarter, more deliberate financial decisions.

Final Thoughts: Tailor Your Banking Strategy to Your Needs

Ultimately, the decision of how many bank accounts to maintain should be guided by your personal financial habits and objectives. Here are a few final recommendations to help you make an informed decision:

- Evaluate Your Lifestyle: Consider your spending habits, income sources, and financial commitments. Multiple accounts can make sense if you’re managing complex income streams or shared living expenses.

- Set Specific Goals: Whether you’re saving for a vacation, a home, or simply want an accessible emergency fund, designate accounts according to these goals. This focused approach turns each account into a savings tool that works for you.

- Review Regularly: Adapt as your financial situation evolves. What works now may need adjustment in a few years, so periodic reviews are essential to keep your strategy aligned with your goals.

- Leverage Technology: Utilize apps and online tools to track your finances effortlessly. These platforms help you figure a path through the fine points of managing multiple accounts, reducing the chance of overlooked fees or missed payments.

As we have explored, the practice of keeping multiple bank accounts is not just a trend—it’s a functional step towards improved financial organization. By taking the time to understand the subtle parts of each account, automating transfers, and leveraging modern technology, you can create a system that minimizes the nerve-wracking issues often associated with managing money.

Why Diversification in Banking Matters

Much like diversifying your investments, spreading your funds across various accounts can limit risk while maximizing benefits. If one account faces temporary challenges such as technical issues or fee increases, you still have other accounts to rely on. This diversification also allows you to take advantage of market opportunities—whether it’s a high-yield savings account online or a rewards program at a local bank branch.

Banking diversification is not merely about having enough outlets to store your money. It’s about customizing each account to enhance your financial strategy, reducing the overwhelm that comes with tangled issues and making it simpler to track every penny you earn and spend.

Embracing a Future of Financial Clarity

As financial institutions continue to innovate, the tools available for managing bank accounts will only improve, allowing you to make smarter decisions with less daily hassle. Whether you’re a small business owner operating on a tight budget or an individual who values clarity and precision in your personal finances, multiple accounts offer an adaptable solution.

By embracing these strategies, you can confidently face the complicated pieces of financial management and secure a future where your money works as hard as you do. The idea is to transform what may seem like overwhelming tasks into manageable and rewarding steps that guide you steadily toward your financial goals.

Conclusion: Crafting Your Financial Roadmap

Ultimately, how many bank accounts you need is a decision that rests on your personal lifestyle and financial goals. Whether you choose one checking account and one savings account or a more segmented structure that includes joint, business, and specialized savings accounts, the key is to be proactive in managing your money.

By carefully considering the benefits and challenges detailed in this article, you can construct a banking strategy that streamlines your finances, reduces the confusing bits of management, and leverages the available digital tools to stay organized. With a clear plan in place, you’ll be well-equipped to figure a path through the twists and turns of modern finance—ensuring that your hard-earned money is always working for you rather than against you.

Remember, the goal is not to complicate your life with unnecessary accounts but rather to customize your banking experience in a way that makes financial sense for you. Whether it’s separating personal and business finances, taking advantage of sign-up bonuses, or simply ensuring that every dollar is allocated to a specific goal, a well-planned approach to multiple bank accounts can be a super important step toward lasting financial stability and growth.

Originally Post From https://www.cnbc.com/select/how-many-bank-accounts-should-you-have/

Read more about this topic at

How diversification builds resilience in banking

How to diversify your cash savings