Small-Growth Funds: Charting a Course Through Volatile Markets

The world of small-growth funds is full of both promise and challenges. With rising interest rates and unpredictable economic cycles, many investors are finding it tricky to steer through market vagaries. Yet, despite the seemingly overwhelming twists and turns, there are seasoned managers who continue to identify promising future leaders. In this op-ed, we get into the details of how some small-growth funds have weathered market storms, why interest rates are having such a significant impact, and what this means for those trying to find their path in this dynamic market space.

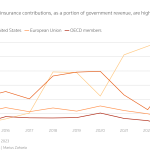

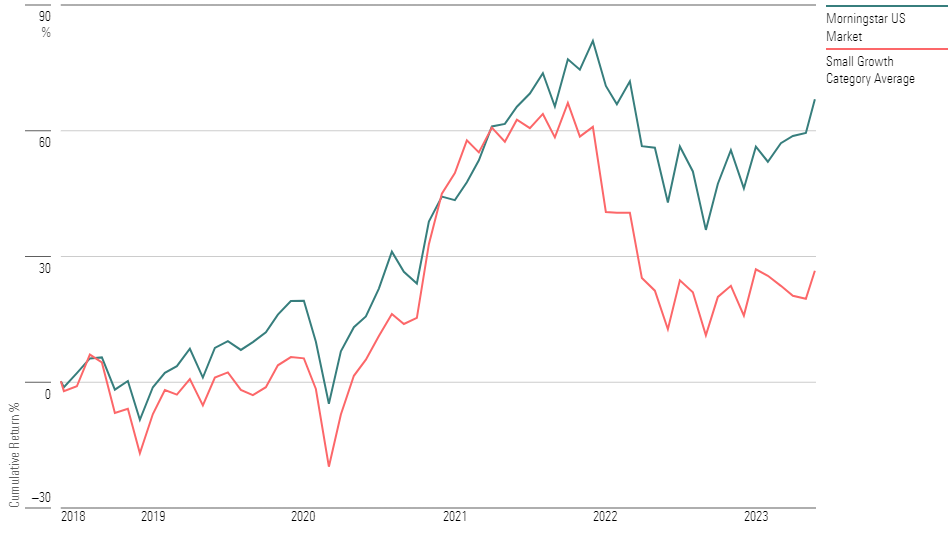

At its core, small-growth investing faces tangled issues that arise from its reliance on long-term future earnings predictions. When interest rates rise, the future cash flows of these companies are worth less, making market volatility more nerve-racking for small-growth investments. For years, indexes such as the Russell 2000 Growth have experienced setbacks, while larger indexes like the S&P 500 and the Russell 1000 Growth have enjoyed much stronger performance gains. The key question, then, is how investors can figure a path amidst such complicated pieces of market dynamics.

Impact of Interest Rates on Small-Growth Investment Strategies

One of the super important factors that have affected small-growth funds is the increase in interest rates. Rising rates lead to a wedge between the pricing of long-dated earnings and the current valuation models, making the market unpredictable for companies that are expected to grow mainly in the future. This has led to performance gaps between different indexes:

- Since its peak in February 2021, the Russell 2000 Growth is down by over 10%, even when compared with the S&P 500’s impressive gains.

- The Russell 1000 Growth, known for its emphasis on larger companies, has outperformed, reflecting a market preference for stability when uncertainty looms.

For investors, these trends are a clear sign that investing in small-growth funds is not for the faint-hearted. The market’s tricky parts, especially during periods characterized by sudden rate hikes and risk-off sentiments, create many confusing bits that can leave both seasoned and novice investors re-thinking their positions.

Quality vs. Aggression: A Closer Look at Managerial Strategies

When market conditions are tense, the role of management becomes even more critical. Some fund managers concentrate on a quality-focused, valuation-centric approach that prioritizes stability over sheer aggressive growth. Take, for instance, Champlain Small Company (CIPSX). This fund is led by Scott Brayman and is recognized for its relatively conservative strategy—it is not chasing the highest short-term gains but is instead carefully evaluating the underlying worth of its investments. The fund’s performance, showing a gain where the broader index suffered, speaks volumes about the strength of this quality approach.

Managers like Brayman understand that in jittery market conditions, protecting capital can be just as important as chasing high returns. While CIPSX may lag behind more aggressive benchmarks in times when the market is roaring, its strategy has proven resilient during setbacks. This is a prime example of how a balanced approach, combining thoughtful selection and risk management, can deliver steady performance over full market cycles.

Key Attributes of a Resilient Fund Manager

- Focused on sound valuation rather than just aggressive growth

- Maintains discipline even when funds underperform in risk-hungry markets

- Prioritizes managing your way through downturns with a quality tilt

- Adapts strategy based on market conditions without losing sight of long-term goals

These attributes are essential when trying to find your path in a market that is often full of problems and sudden shifts. Managers who dig into the fine points and subtle parts of investing are more likely to come out ahead even when the market environment feels intimidating.

Understanding the Performance Metrics: Beyond the Headlines

One of the hardest bits for investors is making sense of performance metrics, especially when indexes tell very different stories. While broader benchmarks have enjoyed significant gains, small-growth funds have had to contend with additional complications due to their focus on future earnings. This discrepancy invites the question: should investors be discouraged by recent underperformance?

The answer is not straightforward. Although small-growth funds like Artisan Small Cap (ARTSX) and WCM Small Cap Growth (WCMNX) have faced setbacks over recent cycles, these funds are built on processes that many funds simply cannot replicate. Artisan Small Cap, for example, is recognized as a highly growth-oriented fund that has, at times, struggled under the weight of frothy valuations. In trying to correct past missteps, the managers have honed their approach—deliberately balancing quality and growth to maximize long-term returns.

Performance Analysis in a Volatile Market

| Fund | Recent Performance Since February 2021 | Key Focus |

|---|---|---|

| Champlain Small Company (CIPSX) | +6.4% (outperforming relative to the index’s loss) | Quality, valuation, and downside resilience |

| Artisan Small Cap (ARTSX) | Underperformed, ranking in bottom decile over five years | Growth orientation with efforts to correct overreliance on high valuations |

| WCM Small Cap Growth (WCMNX) | About a 10.2% loss, similar to the Russell 2000 pullback | Competitive advantages combined with exposure to volatile sectors like biotech |

By looking at the finer details of each fund’s performance, investors can start to figure a path that fits their appetite for risk and their investment horizon. The table above highlights how different small-growth funds have performed amid a market loaded with issues, providing insights into which strategies might best suit long-term goals.

Digging into the Small-Cap Market: Risks and Rewards

The small-cap landscape is rife with challenges that can make it seem overwhelming. However, the same market is also ripe with opportunities—if one can identify the right companies and manage the wave of sudden market shifts.

One of the most complicated pieces in the equation is the identification of companies that are poised for future growth, even when current metrics might appear off balance. It’s here that funds like Artisan Small Cap (ARTSX) and WCM Small Cap Growth (WCMNX) demonstrate their strengths, identifying businesses that are on the brink of entering profit cycles.

Elements to Consider When Evaluating Small-Cap Opportunities

- Valuation Sensitivity: Small-growth stocks are highly sensitive to changes in market sentiment, meaning that even a minor adjustment in valuation standards can cause significant swings.

- Management’s Expertise: The skill required to dig into the subtle details and the fine shades of each company’s prospects is paramount. Successful managers often do not shy away from the confusing bits of future-oriented sectors.

- Sector Exposure: Exposure to sectors such as biotechnology can dramatically alter performance, as these stocks can be extremely volatile, amplifying both gains and losses.

- Macro Trends: External factors such as interest rate adjustments, geopolitical tensions, and overall economic fluctuations must be considered when assessing small-cap growth funds.

These elements, when combined, paint a comprehensive picture of the nitty-gritty that investors need to consider. By understanding these subtle parts and fine shades, one can make more informed decisions about whether to commit to a small-growth strategy amid the current market upheavals.

Biotechnology in the Small-Cap Space: Balancing Innovation with Risk

A notable point of differentiation among small-growth funds is their approach to new sectors, particularly biotechnology. WCM Small Cap Growth (WCMNX) is one example where the portfolio managers include young biotechnology companies alongside more traditional competitive advantage plays. While biotech stocks can provide outstanding potential, they also represent one of the more nerve-wracking aspects of any portfolio.

This dual exposure means that investors might see performance that is quite distinct from more straightforward quality-oriented funds. The exposure to biotech can sometimes lead to sudden swings, making the overall portfolio feel full of problems during turbulent times. However, the ability to seize upon breakthrough innovations in these companies can also be a major driver of long-term success if managed properly.

Pros and Cons of Biotech Exposure in Small-Growth Funds

-

Pros:

- Opportunity for outsized gains when breakthroughs occur

- Potential to ride waves of innovation in a rapidly evolving sector

- Diversification benefits within a small-cap focused portfolio

-

Cons:

- High volatility that may lead to unpredictable returns

- Sensitive to macroeconomic shifts and policy changes

- Require deep industry knowledge and agile management

The challenge for fund managers is to balance the promise of biotech flair with a strategy that doesn’t become too overexposed. For investors trying to find their way in a market that is sometimes off-putting due to its sudden and severe moves, exposure to biotech must be approached with caution, yet recognized for its potential upside.

Strategies for Managing Through Market Downturns

Investors who are eyeing the small-growth segment must be ready to work through some nerve-racking stretches. Even the most resilient funds have periods of underperformance compared to broader benchmarks. The key, however, is to maintain a long-term perspective and trust in a systematic, research-driven process.

For instance, funds like Champlain Small Company have demonstrated an ability to bounce back by sticking to a conservative, valuation-focused process. This type of approach helps guard against the sudden jolts of market instability by focusing on companies with inherent value rather than chasing trends that could prove short-lived.

Essential Tactics to Weather Tough Cycles

- Diversification: Spread investments across various sectors within the small-cap world to reduce risk when one area is hit by market turbulence.

- Risk Management: Emphasize strategies that limit downside potential, such as quality-focused stock selection and careful monitoring of fast-moving sectors.

- Long-term Focus: Avoid knee-jerk reactions to short-term fluctuations. Instead, keep an eye on longer market cycles and overall economic trends.

- Managerial Discipline: Work with fund managers who have a proven track record of steering through complicated pieces of market volatility.

The above tactics can help investors get around some of the more intimidating aspects of the small-growth investment landscape. Whether you’re a seasoned investor or someone trying to figure a path in this market, understanding these strategies is key to building a resilient portfolio.

Comparing Small-Growth and Broader Equity Markets

An interesting observation in recent years is the stark contrast between the performance of small-growth funds and broader equity benchmarks. While the S&P 500 and the Russell 1000 Growth indexes have enjoyed robust gains, the more targeted small-growth segment has lagged behind. This divergence is a product of several factors:

- Exposure to Future Earnings: Small-growth stocks are often priced based on expectations of long-term growth, which become less appealing when current economic conditions are unpredictable.

- Risk Preference: Investors in broader equity markets might prefer the stability of established companies during times when market conditions feel off-putting.

- Management Approach: While some fund managers take on riskier strategies, others adopt a more conservative stance, resulting in varied performance across funds.

For investors comparing performance across these different market segments, it’s important to keep these subtle details in mind. The challenges small-growth funds face are not merely a reflection of poor management or sector bias, but a consequence of a deeper market structure that favors stable, income-generating companies during turbulent times.

Exploring the Potential for Upside in Small-Growth Funds

Despite the current market headwinds and occasional setbacks, there is still significant promise in the small-growth space. Many industry experts and fund managers assert that there remains a strong positive alpha potential in these funds. In other words, while the current environment is loaded with issues, the opportunity for outsized gains is very much alive for those companies that manage to break through the noise.

For investors who have the patience to see beyond the near-term fluctuations, opting for small-growth funds may indeed be a good strategy. The path to success in this area is filled with twists and turns, but with careful analysis, a focus on quality, and skilled fund management, the odds can be tilted in favor of long-term gains.

Indicators of Long-Term Upside in Small-Cap Investments

- Skilled Management: Funds that have demonstrated a consistent strategy in selecting high-quality companies tend to outperform over full market cycles.

- Market Timing: Even small growth stocks can benefit when the market eventually shifts its focus back to future growth potential, particularly as economic conditions improve.

- Quality of Holdings: A portfolio rich in companies with robust business models and competitive advantages will tend to weather downturns better than one focused solely on high valuations.

These indicators suggest that while short-term results might appear disappointing, the underlying fundamentals of many small-growth funds remain sound. Investment strategies that emphasize careful selection and a disciplined approach could pave the way for significant long-term rewards despite the current volatile environment.

Investor Considerations in a Changing Economic Landscape

Today’s market environment is unmistakably challenging, especially for those vested in small-growth funds. The combination of rising interest rates, unpredictable economic policies, and sector-specific risks means that investors must be more alert than ever. Here, we offer some advice on how to get into the nitty-gritty of current market conditions, manage your way through downturns, and maintain confidence despite short-term setbacks.

Top Factors Investors Should Keep in Mind

- Market Trends: Stay updated on broader economic trends that could affect interest rates, consumer spending, and other key factors.

- Sector Specifics: Understand the industries within your portfolio. For instance, technology and biotech sectors can swing wildly relative to other sectors, influencing overall performance.

- Managerial Track Record: Evaluate the historical performance of a fund’s management team, particularly their ability to figure a path during market downturns.

- Diversification Strategy: A well-diversified portfolio can help limit the impact of sudden, dramatic market shifts.

While some investors might feel overwhelmed by the sheer number of twists and turns in today’s economic landscape, constant vigilance and a focus on long-term outcomes can help cut through the noise. The key is to continuously assess which fundamental elements remain super important for sustained portfolio growth.

Future Outlook: A More Optimistic Perspective?

Looking ahead, there are reasons to remain cautiously optimistic about the prospects for small-growth funds. History has taught us that markets are cyclical, and what we see today in terms of underperformance relative to broader indexes may well be reversed in the coming years.

Many of the challenges—such as rising rates—might eventually give way to conditions that favor growth spurts in innovative, agile companies. As the global economy adjusts and investors get around the intimidating aspects of near-term volatility, the long-anticipated rebound for small-growth funds might finally be underway.

Signs That the Small-Growth Rebound is on the Horizon

- Economic Recovery: As overall economic conditions stabilize and interest rates normalize, companies with strong growth prospects could see earnings rebound, translating into improved fund performance.

- Innovative Breakthroughs: Advances in technology and biotech could provide the spark needed to boost stock performance in the small-cap arena.

- Adaptable Fund Management: Skilled managers who can get into the little details, adjust their strategies, and rapidly respond to market shifts are well poised to lead their funds to a recovery.

- Positive Market Sentiment: An overall shift in investor sentiment toward a greater appetite for risk may eventually benefit small-growth funds as market focus returns to future earnings potential.

With these signs in mind, investors should consider small-growth funds not merely as short-term bets but as long-term investments that, given time and favorable conditions, can offer substantial upside. The opportunity lies in the delicate balance between managing risk and capitalizing on future growth potential.

Final Thoughts: Walking the Tightrope of Risk and Opportunity

In summary, the journey of small-growth funds in today’s market is a complex trek through unexpected rate hikes, market volatility, and sector-specific risks. However, for investors who are willing to poke around the fine points and subtle parts of fund management, the rewards can be significant. It is essential to work with fund managers who have the courage to take calculated risks, a discipline to protect against sudden downturns, and the foresight to focus on long-term fundamentals despite the confusing bits of current market conditions.

Whether you choose a fund like Champlain Small Company with its resilient, valuation-focused approach, or lean toward strategies like WCM Small Cap Growth that mix competitive advantages with calculated biotech exposure, the key is to remain flexible, alert, and patient during times that are often loaded with issues. By maintaining a long-spectrum view and aligning your investments with funds that have a proven process, you can better steer through the tangled issues of today’s market and position yourself for future growth in a sector that remains full of potential.

Strategies for Long-Term Success in Small-Growth Investing

For those committed to small-growth investing, the road ahead is filled with challenges but also considerable opportunities. Here are some strategies for working through market waves:

- Thorough Research: Spend time digging into the business models of target companies. This means reading annual reports, understanding competitive advantages, and evaluating market positions.

- Steady Diversification: Avoid putting all your eggs in one basket. Spread risk across multiple funds and sectors to manage your way through unexpected downturns.

- Sticking to Fundamentals: Even in times of apparent market headwinds, ensure that your investment decisions are grounded in super important, time-tested fundamentals.

- Maintaining Patience: Markets are inherently nerve-wracking at times, but investing with a long-term focus helps smooth out short-term bumps in the road.

These strategies not only help manage risk but also position an investor to capitalize on the recovery when macro conditions eventually evolve in favor of growth stocks. In times like these, robust investment decisions are nurtured by a balanced mix of analytical rigor, management discipline, and a deep understanding of both the obvious and the hidden complexities of market movements.

Conclusion

The story of small-growth funds today is one of resilience, cautious optimism, and strategic adaptation. While the sector faces a barrage of overwhelming challenges—from rising interest rates to sector-specific volatility—there is a silver lining in the form of skilled managers who manage to figure a path through tangled issues. A focus on quality, disciplined risk management, and the ability to get into the little details of company fundamentals can make a significant difference, even when the broader market seems unpredictable.

Ultimately, the decisions investors make now—despite the nerve-racking twists and turns of a charged economic environment—could lay the foundation for a much brighter future in the small-cap growth arena. By embracing a long-term outlook, diversifying portfolios, and partnering with managers who have proven their mettle over full market cycles, investors may not only weather the current storm but also position themselves to benefit from the anticipated rebound when market conditions stabilize.

As the global economy adjusts and market sentiments shift, staying well-informed, remaining patient, and consistently evaluating investment strategies will continue to be key. For those willing to work through the confusing bits of short-term volatility, the journey in small-growth funds promises to be one of both challenge and opportunity—a reminder that in the world of investing, persistence and strategic insight remain some of the most effective tools in your arsenal.

Originally Post From https://www.morningstar.com/funds/small-growth-funds-with-rebound-potential

Read more about this topic at

Small-Cap Stocks Poised for Resurgence: A Deep Dive into …

The forgotten asset class: U.S. smaller companies could be …